You can utilize unsecured loans for almost all good grounds particularly so you’re able to combine loans, funds a house improvement opportunity, otherwise pay money for a major debts.

According to the interest your qualify for, an unsecured loan can help you save money by steering clear of carrying a balance on the credit card.

In this Citibank Personal loans opinion, we will examine prices, charges, and you may qualities some other federal, on the web banking companies and other loans providers.

How do i Meet the requirements and you can Exactly what Charges Do i need to Spend?

- Annual money out-of $10,five-hundred or higher

- Only about you to definitely open unsecured loan off Citibank

- When you have a current unsecured loan out of Citibank, it must not have already been unwrapped prior to now 6 months.

- There is absolutely no deposit expected to unlock an unsecured loan without fee to have early installment of the mortgage.

How much time Can it Sample Obtain the Currency?

Approval and you may handling usually takes 2-3 weeks based your personal points. Big financing have a tendency to take longer so you’re able to techniques and agree than reduced finance.

Secure Perks That have Matchmaking Banking

You can receive issues for money right back, provide notes, gift suggestions, and you may travelling. You can even have fun with ThankYou things to pay their expense.

Based what type of account you really have, you can generate sometimes 50 otherwise 125 ThankYou situations monthly by the connecting the mortgage to help you an excellent Citibank checking account. Whilst it might not be far, taking advantage of the offer feels like taking free money.

Get a speeds Avoidance

For individuals who assist Citi instantly do the payment from your Citibank checking account, their interest rate will immediately getting less.

Citibank consumers will get an amount all the way down price whether they have more $200,000 for the possessions having Citibank. For those who meet up with the requirement, you’ll instantly receive the faster rate of interest.

Ways to get Recognized to have an unsecured loan

When you submit an application for a personal bank loan you’ll want to provide guidance and so the lender can also be influence what you can do and work out money. Some of the guidance you’ll want to bring become:

- Title

- Address

- Go out regarding beginning

- Proof identity, such a license

- Personal Protection matter

Your credit rating will additionally be a large reason behind determining for those who qualify for the loan. A good credit score usually both enhance your odds of getting the mortgage and relieve the rate to your loan.

The higher the newest part of the credit limit you utilize, the latest less likely it is that you are able while making costs into the almost every other fund. Repaying your own mastercard balances will reduce so it proportion, boosting your credit.

Another option for folks who have derogatory scratching, for example late otherwise overlooked money, to their credit report should be to plan out a pay-for-delete agreement.

Get in touch with the financial institution who you didn’t spend and inquire in the event that might get rid of the draw from your credit file for individuals who settle your debt together. Of several could be ready to workout a deal.

The lower new proportion, the greater your chances of bringing accepted. You can decrease the ratio by paying off your financial situation or boosting your income.

In the end, ensure that you try trying to get a personal loan to own the best reasoning. A  loan provider is much more going to accept that loan removed to own a description particularly merging current expenses than for delivering a deluxe trips.

loan provider is much more going to accept that loan removed to own a description particularly merging current expenses than for delivering a deluxe trips.

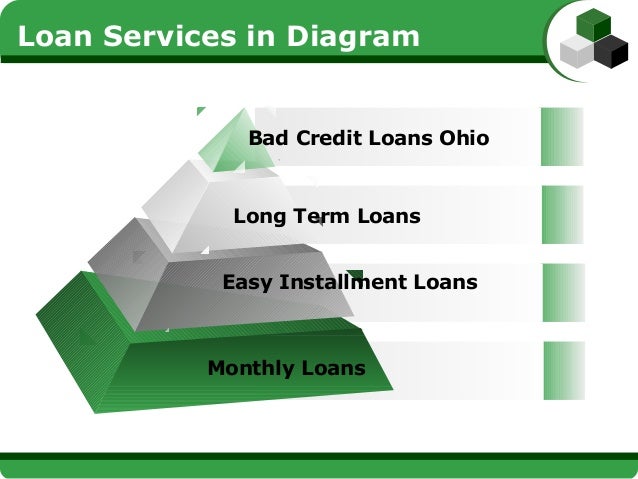

Signature loans off their Loan providers

Of a lot financial institutions and loan providers give signature loans. If you are not currently a customer regarding Citibank or cannot fulfill their criteria, there are other towns and cities for personal fund:

Upstart

Upstart try an online company that gives unsecured loans to own an effective wide selection of need. Funds can be short given that $1,000 and also as large as the $50,one hundred thousand. According to loan, you’ll have often step 3 or five years to blow they back.

Really loan providers look at your credit score, earnings, and you can financial obligation-to-income ratio when choosing whether or not to build a loan and how far notice to help you costs.

Upstart and additionally considers your education, part of research, and you can a position history. While you are well educated in and in-consult industry and have a stable work record, you are prone to meet the requirements during the Upstart, despite less than perfect credit.

Another thing that makes Upstart stick out is the fact it takes only 24 hours for money to-arrive on your own membership. If you have a very immediate importance of dollars, that may create all the difference.

Credit Pub

Credit Bar is just one of the premier fellow-to-fellow financing websites that offer signature loans. You can sign up for a loan as large as $forty,000 regarding Financing Bar.

Rather than a bank, Financing Bar will not make the loan to you personally. Instead, Financing Pub links you along with other anyone else who would like to invest their cash for the unsecured loans.

After you sign up for the borrowed funds, Financing Pub will publish the details of your loan (having determining suggestions got rid of) to help you dealers. Buyers are able to decide if they will certainly let finance your loan, just in case they’ll, to what extent.

Your personal mortgage could possibly are from multiple traders. After you create repayments with the financing, different people will receive their express of the payment. Financing Club offers unsecured loans to have scientific expenses, vacations, home improvement, and debt consolidation reduction.

Santander Financial

Santander Bank offers unsecured loans amounts ranging from $5,100000 and you may $35,100000. You might occupy so you can 5 years to blow the loan right back. You can also get a performance avoidance if you make automated repayments through good Santander family savings.

Check around If you aren’t Already a Citibank Consumer

The pros that you will get regarding connecting your loan to a bank account can save you a king’s ransom along the course of the loan.

Otherwise have an account having Citibank, you have to do significantly more doing your research. Pick the bank that can offer how big the newest financing you desire, into reasonable costs and you can interest rate.